It is user-friendly and has features like automatic reminders and reminders based on location to ensure you never miss a meeting or deadline. Over 60 million users have downloaded Workday, and it is still growing at a rapid pace. It is a helpful tool for busy people who want to stay productive without the hassle of scheduling or remember when they have to work.

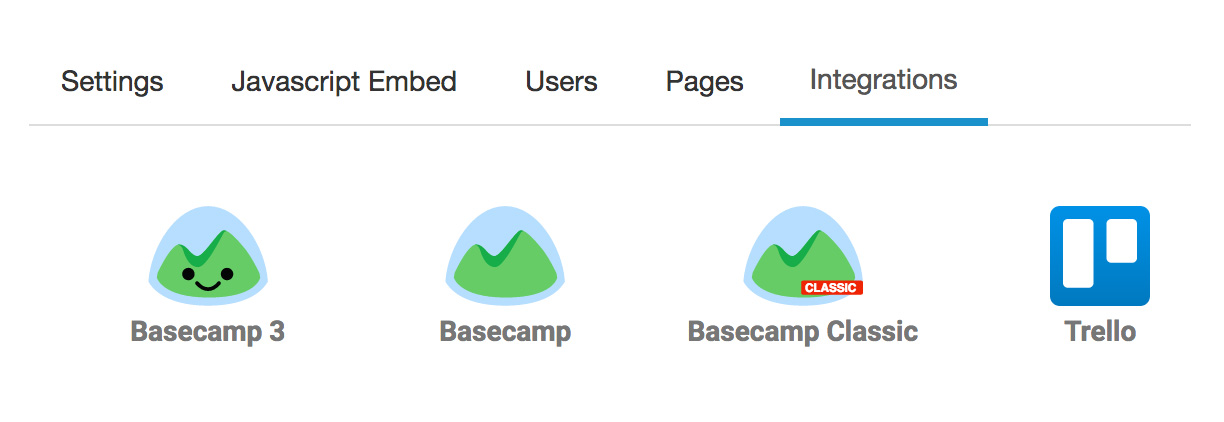

#Basecamp 3 slack integrations software

Workday (NASDAQ:WDAY) is an AI-based software that helps users manage their calendar and tasks. Therefore, Salesforce is a must when talking about tech stocks these days. Salesforce forecasts annual sales to top $50 billion in fiscal 2026, which means that the payment is expected to jump by 17.4% over the next four years across different verticals. Despite the company’s recent slump, its growth trajectory will quell any worries about their slowing down. Apart from the wider tech selloff, investors are concerned that work management software will not do well with things opening up. And it’s understandable why this is happening. In the year thus far, its shares have not done well. Salesforce is at present one of the most widely used CRM software globally, and it is constantly innovating to stay ahead of its competition. Its software helps companies interact with customers and manage the business process, saving a lot of time, effort, and money. Salesforce has significantly changed the business world. They spare you the hassle of managing customers yourself and grant you the time to develop your own business. Salesforce (NYSE:CRM) is a company that provides tools and services to help companies manage their relationships with customers and potential ones. To sum up, the company continues to generate profits for investors, making its stock more lucrative. It is worth mentioning that its dividend raised over the past four quarters and is expected to increase again. Demand for its products continues to exceed supply.

Microchip’s recent quarterly earnings underscored the company’s continued robust performance, with record high revenue, gross margin, and operating profit.

They have set foot in many markets, and their product lines are becoming more diverse every year. Microchip is a leading provider of automated machine parts, IoT devices, and automotive products. One of the most important companies supporting this is Microchip Technology. They can even be embedded in clothes and shoes that we wear! Its future is bright, but there are a lot of things still need to be improved on before they can be fully implemented into our daily lives. Microchips are now being used in cars, phones, and computers. You can use it for many things, such as digital circuits, sensors, and actuators. Microchip Technology (NASDAQ:MCHP) is a highly integrated circuit on a single piece of silicon. WiMi is the world’s leading holographic cloud platform, a fast-growing company that is capitalizing on the metaverse, a market opportunity worth hundreds of billions of dollars.

It has become the standard way of signing documents because it saves you a lot of time and effort when signing papers securely online. Microsoft is an all-weather performer that does well regardless of the state of the economy.ĭocuSign is a cloud-based service that allows users to sign documents electronically. However, its market value went down rapidly this year. Netflix is one of the most popular streaming services globally, and it has been growing rapidly in recent years. Workday is a software vendor specializing in human capital management, financial management, and work-from-home support. They have invested heavily in algorithms that can do a wide range of work, including making sense of human languages. Salesforce is one of the leading companies in the AI revolution. The following 7 tech stocks are already oversold and are believed to be expected to yield good returns over time. Some terrific tech stocks are currently trading at bargain prices in the market. But with international geopolitical risks and rising expectations of a global recession, the Nasdaq is down more than 27% year-to-date, and the market’s sharp pullback has brought the valuations of many high-quality technology stocks down to more reasonable levels.Ĭonsidering that tech stocks have stronger growth capabilities, they tend to be the biggest beneficiaries of the rally when the market turns around. They have been performing well in recent years because of the growth of the Internet and technology sectors.

0 kommentar(er)

0 kommentar(er)